Want To Boost Your Profit? Explore These Best Short-Term Investments

Feb 06, 2024 By Triston Martin

If you want to gain wealth, then you have to make investments. Generally, investments are classified in two forms; Long-Term and Short-Term investment.

Long-term investments favour those investors who have patience, while short-term investments are best for people who want a safe place to invest their money for low risk and high liquidity.

However, short-term investments aren't just a piece of cake. Finding the best investment option at the right time to get a high yield is quite a big challenge. That's why we've covered the 7 best short-term investments so that you can grow your profits in 2024.

Short-Term Investments (With Low Risk and High Returns)

There are dozens of investments for every investor. But below, we have discussed the seven best short-term investments you can figure out and get the best returns possible for your capital:

High-yield Saving Account

Imagine your hard-earned dollars not just sitting but growing at a good pace. If you want the best short-term investment options with high returns, consider investing in a high-yield savings account.

With a savings account, you enjoy a win-win situation – liquidity and significant interest rates.

High-yield savings give you a competitive advantage over other risky assets if you're saving for a dream vacation, emergency fund, or future investments.

The best part of investing in these accounts is that these accounts are connected with insurance companies like FDIC (where the insurance company covers up to $250k). That's why you should always keep your money and never lose it.

Banks like Lending Club offer 4.65% APY, while Synchrony Bank provides 4.75 % APY. Also, these savings accounts are highly liquid, meaning you can easily access your capital whenever you want.

Money Market Account

Money Market accounts are similar to saving accounts. The most significant advantage of investing in these accounts is that they provide a higher yield compared to a savings account. But it also requires a higher minimum deposit. That's why it is one of the best way to invest $10,000 short term.

It is best for people who want to invest money for a short duration and want to access their capital easily. Also, ensure that FDIC ensures the bank where you're opening your market account.

"First Internet Bank of Indiana" provides 5.46% APY. Meanwhile, CFG bank gives 5.25% APY. However, remember that your interest rate should be higher than the inflation rate in your country.

U.S Government Bonds

Third on the list of 7 best short-term investments are U.S government bonds. It is usually for investors looking for diversification. The government backs these bonds, so there is no risk at all. But remember, low risk means low reward.

These are best for short-term investors looking for high liquidity. It is considered the safest investment, with low-interest rates.

In order to buy these government bonds, you must visit treasurydirect.gov and invest at least $100. An alternative to this is government bond funds, where you can want to invest in a mix of various bonds. Government Bonds could be the best short-term investment/diversification for you.

Corporate Bond Funds

Corporate bond funds offer several benefits to their investors. These funds typically pay regular interest payments, providing investors with a predictable income stream.

It often offers higher yields than government bonds due to the additional risk associated with corporate debt.

These bond funds provide liquidity through regular trading on the open market. The biggest pros of investing in these funds are that you won't rely on only one bond. If the first bond isn't performing well, the other bonds will cover them.

One of the main cons of this fund is credit risk. If the issuing company faces financial difficulties or defaults, bondholders could experience a loss of principal or missed interest payments. In contrast, some corporate bonds may have lower liquidity.

You can buy them virtually through any online broker that provides mutual funds or ETFs.

Money Market Mutual Fund

A money market mutual fund is a low-risk investment for the short term. These funds are highly liquid and more stable than other investments. It allows its investors to access their funds by selling shares or making withdrawals quickly.

Generally, it exhibits low volatility compared to other investment options. The funds are easily accessible to individual investors.

Although this investment focuses on low-risk securities, there is still some credit risk. Regulatory changes can also impact the structure or returns of money market funds.

This investment is also liquid; you can access your cash according to your needs. You can buy this fund from brokers that sell mutual funds.

Treasury

Issuing Treasury in three forms—T-notes, T-bills, and T-bonds—the government positions T-bills as low-risk investments due to their short maturity (usually less than one year). These highly liquid instruments are easily tradable in the secondary market before maturity.

T-bills are considered risk-free, with the government obligated to repay the principal and interest.

On the dark side, T-bills typically offer lower yields than riskier investments. T-bill returns may not keep pace with inflation, leading to a potential decrease in purchasing power over time.

You can buy treasury notes or bonds from treasurydirect.gov or any broker selling individual bonds.

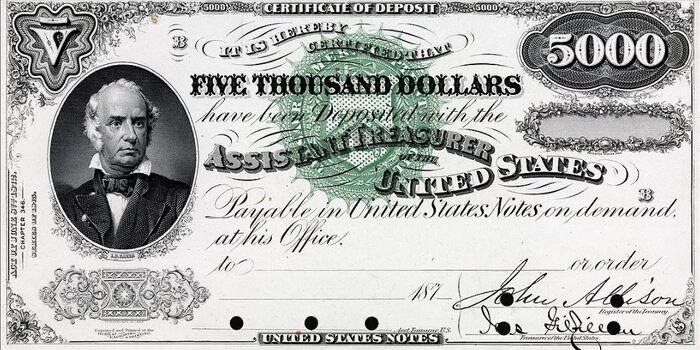

CD

CD or Certificate of Deposit is a different form of deposit, where FDIC also insures your money. CDs are different from other high-yield saving accounts.

In this deposit, you set the amount you want to deposit, and your capital gets locked in for that period. You can deposit your money ranging from 3 months to 5 years. Usually, the greater the time duration, the higher the yield you will receive. This could be the best fit for you if you've got short-term investment plans for 6 months.

This investment is best for people looking to save for a new house. So, CDs are one of the best short-term investments for investors. In addition, if you want instant access to your cash, then consider a no-penalty CD (which allows easy withdrawals for free).

Ally Bank and Synchrony Bank also offer no-penalty CDs.

Bottom Line

To conclude, these are the 7 best short-term investments, waiting for investors. It all comes down to your patience, risk appetite, and financial intellect. Most of the accounts mentioned above are FDIC insured (so your hard-earned money is protected by the U.S. government). So, make sure to plan your investment or discuss it with a finance professional before you invest.

Susan Kelly Oct 23, 2023

What Is the Nasdaq Capital Market? What You Need To Know

30974

Susan Kelly Jan 29, 2024

Home Buying and Selling: The Role of Agent Referral Networks

24991

Triston Martin Feb 01, 2024

E*TRADE vs. Fidelity: A Comprehensive 2024 Brokerage Face-Off

11481

Susan Kelly Feb 23, 2024

Understanding the Importance of a Debt Validation Letter

83271

Susan Kelly Feb 01, 2024

A Beginner's Guide to Corporate Bonds: Definitions and Purchase Tips

16055

Triston Martin Dec 05, 2023

Beginner's Guide to Credit Cards: Top 6 for Getting Started

1904

Triston Martin Feb 06, 2024

Choosing Between Personal and 401(k) Loans: Insights for Financial Planning

48034

Triston Martin Nov 17, 2023

Investors who are bullish vs. bearish: What distinguishes them?

92067