Understanding Cash Flow Statements

May 17, 2024 By Susan Kelly

Cash flow statements are very important financial documents for a business. These give details about how money comes in and goes out of the company during a particular period. When we look at cash flow statements, it helps people involved in the business to understand its ability to pay short-term debts (liquidity), long-term debts (solvency), and overall financial state. In this article, we will talk more about why cash flows are important and what makes up these statements, using real examples to help you understand better.

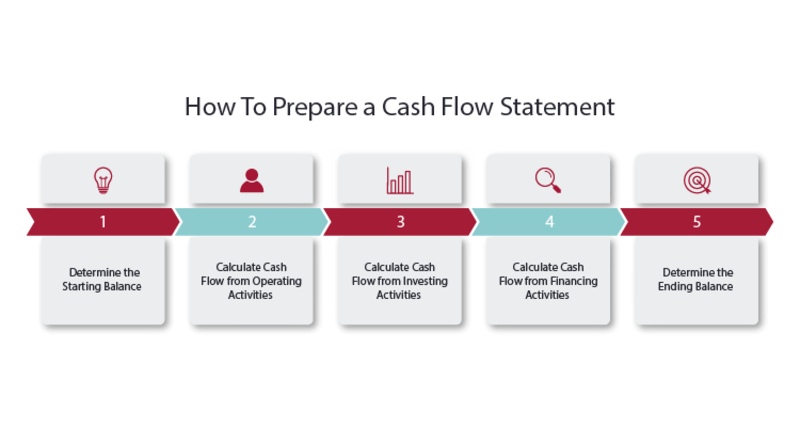

1. The Structure of a Cash Flow Statement

The usual cash flow statement has three main parts: operating activities, investing activities, and financing activities. Each part explains a different kind of financial action by the company. Operating activities are concerned with money coming in and going out from main business operations. For example, income through sales or paying suppliers. Activities of investing cover cash movements connected to investments in items such as property, equipment, and securities. Activities of financing give information about cash transactions that involve debt, equity, and dividend payments.

A nicely arranged cash flow statement does not just give a quick look at how a company is doing financially, but it also helps with strategic decisions and relations with investors. When cash flows are separated into different groups, people who have an interest in the business can examine where money comes from and how it gets used. They can also spot patterns over time and understand if the company is good at making ongoing cash flows.

- Transparency: Cash flow statements enhance transparency by revealing the sources and uses of funds, fostering investor confidence.

- Comparative Analysis: Comparative analysis of cash flow statements over different periods offers insights into financial performance trends and areas for improvement.

2. Operating Activities - Unveiling Business Operations

The part of a cash flow statement about operations shows the money made or spent by the main business activities of a company. This involves cash received from clients, payments for supplies and workers' salaries as well as other costs related to running like rent and utilities. Positive cash flows from operating activities indicate that the firm is successfully creating money through its main business endeavors, while negative ones might hint at difficulties with liquidity or operational effectiveness.

The operations of a business are its main source of income, showing how effectively it manages resources and conducts daily financial activities. Analyzing this section helps to understand the company's ability to make money, control costs, and overall operational effectiveness.

- Working Capital Management: Efficient management of working capital is crucial for maintaining positive cash flows from operating activities and sustaining business operations.

- Quality of Earnings: The operating cash flow ratio assesses the quality of a company's earnings by comparing operating cash flows to net income, indicating how much of the reported profit is backed by actual cash flow.

3. Investing Activities - Capital Expenditures and Acquisitions

In the area of investing activities, companies reveal the cash flows linked with purchasing and selling long-term resources, making investments, and participating in mergers or takeovers. Outflows of cash in this part usually come from capital expenses like buying property, plant, and equipment as well as putting money into stocks or bonds. On the other hand, inflows of cash appear because of asset selling or investment returns. Analyzing investing activities offers insights into a company's growth strategies and capital allocation decisions.

Activities related to investment have a crucial effect on the forthcoming growth and strategic path of a business. The comprehension of these cash flows helps those involved to review management's choices in investing, evaluate possible dangers and profits linked with capital expenses, as well as predict future requirements for funding.

- Risk Assessment: Investing activities reveal the level of risk associated with a company's investment decisions and its commitment to long-term growth.

- Capital Allocation Efficiency: Assessing the proportion of cash flows allocated to investments helps stakeholders evaluate management's efficiency in deploying capital to generate returns.

4. Financing Activities - Capital Structure Dynamics

The part about financing activities shows how cash is coming in or going out about getting money from investors and paying back what is owed. Cash that comes in from financing activities may be from selling stocks or bonds, getting loans, or other ways of external funding. On the other hand, money flowing out could be used for paying dividends to shareholders, returning debts, or buying back stocks. Knowing about financing activities is very important for analyzing the capital structure of a company and deciding if it can handle its financial responsibilities.

Activities of Financing show how the capital structure of a company changes and what plans it has for getting money to run its operations and grow. By looking at these cash flows, people who have an interest in this company can understand the way it uses leverage, solvency, and dividend policies. This gives them an important understanding of the financial condition and stability of that particular business.

- Debt Management: Monitoring cash flows from financing activities aids in evaluating a company's ability to manage debt levels and service interest payments.

- Investor Confidence: Dividend payments and share buybacks influence investor confidence and perceptions of the company's financial strength and prospects.

5. Examples of Cash Flow Statements

For example, let's look at some imaginary cash flow statements for two companies. The first is Company A which does manufacturing and it shows good cash flows from operating activities due to high sales income and clever cost control. On the other hand, Company B, a new business in the technology field, shows negative cash flows related to its investments as it puts lots of money into research and development for future expansion possibilities.

Looking at actual cases of cash flow statements in the real world helps to comprehend and use financial ideas. When we compare statements from various companies in different fields, it gives us an important understanding of what affects cash flows and how this influences their financial strength along with choices they make for managing money.

- Industry Dynamics: Consider industry-specific factors that may influence cash flow patterns, such as seasonality, regulatory changes, or technological disruptions.

- Risk Considerations: Evaluate the level of risk associated with different cash flow profiles, considering factors like market volatility, competitive pressures, and macroeconomic conditions.

Conclusion

To end, cash flow statements are very important tools for checking how well a company is doing financially and making good choices. By understanding the details about operating, investing, and financing activities we get from these statements, people who care about the business can learn crucial things about its cash flow trends. They can also evaluate if it has enough money to keep going with its operations, explore chances for growth, or handle financial dangers skillfully. With this detailed comprehension in view, individuals may approach the intricacies of financial management with assurance and clearness.

Triston Martin Feb 01, 2024

E*TRADE vs. Fidelity: A Comprehensive 2024 Brokerage Face-Off

17319

Susan Kelly Dec 23, 2023

Comparing Phone Trade-Ins and Sales: Assessing the Better Financial Gain

1588

Susan Kelly Dec 21, 2023

The Rise and Fall of General Electric (GE): A Comprehensive Guide

86322

Susan Kelly Jan 15, 2024

What's The Distinction Between Equity and Debt Financing

90795

Susan Kelly Jan 29, 2024

Home Buying and Selling: The Role of Agent Referral Networks

34170

Triston Martin Dec 24, 2023

Everything About SEC Form 10-Q: Filing, Deadlines, and Key Components

54788

Triston Martin Jan 22, 2024

5 Essential Facts About the Cred.ai Credit Card: A Comprehensive Guide

84101

Triston Martin Dec 30, 2023

Detailed Overview of the Balance Sheet: Components and Examples

34094