Do You Know: How To Cancel a Pending Transaction

Jan 06, 2024 By Triston Martin

Introduction

It should be possible to cancel a pending transaction by tapping the notice and choosing "cancel" from the drop-down menu; however, this is not always the case. Pending can indicate that the transaction has been halted at any point along its path between the sending and receiving banks. This makes the cancelling process more difficult for the sender. In this piece, we'll review the fundamentals of cancelling a pending transaction, including how to do it on your debit card and PayPal account and when you should get in touch with your financial institution. Here you’ll learn how to cancel a pending transaction.

How A Pending Transaction Works?

The transaction goes through several verifications and authorization checks when you purchase a debit or credit card. To start, the store will be able to verify your card's validity thanks to the POS system. The purchase is then approved by your financial institution, credit union, or card issuer. However, the transaction is incomplete until your Bank transfers the money to the Merchant on your behalf. It takes time to process all of these steps. Pending refers to the state of your transaction while it is being processed. A pre-authorization fee ensures the Merchant has access to additional funds should the actual value of your purchase exceed the amount charged.

Can You Cancel a Pending Credit Card Transaction?

You cannot usually challenge a charge already processed on your credit card or debit card. Due to the possibility that a pending amount will alter once it posts, credit card providers and banks typically only assist with concerns about posted charges (for example, when a tip is added to a restaurant transaction). If you have any questions or concerns about a charge that has been authorized but has not yet been processed, you should contact the Merchant directly for assistance. The Merchant may cancel an unfinished purchase before it is added to your account.

Disputing A Pending Transaction

Since pending charges are only temporary and the final amount of the charge may alter, credit and debit card providers do not allow you to challenge them. Once a transaction has been concluded, the issuer cannot revoke or amend it. Before then, you'll need to get in touch with the Merchant who initiated the charge if you want to reverse the transaction. Depending on the circumstances, they may be able to call your card issuer and cancel the charge. The pending transaction should be removed as soon as they do, and the funds or credit should be reinstated in your account. If you suspect the pending transaction is fraudulent or the Merchant is uncooperative, you should contact your bank or credit card issuer for assistance.

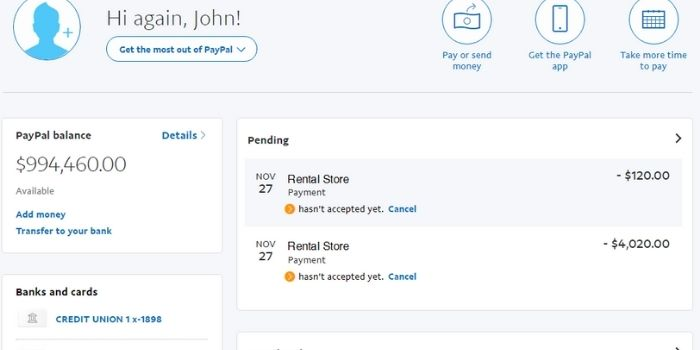

How To Cancel a Pending PayPal Transaction?

There are two potential explanations for a pending transaction after transferring money to someone else. To begin, you may have sent funds to an individual whose contact information isn't affiliated with a valid PayPal account, such as a mobile phone number or email address. In such a case, head to your account's "Activity" section to cancel the payment. If this is not the case, you may have paid money to a vendor who does not support recurring payments. This implies the store has the last say over whether or not they receive your payment. You cannot reverse a payment to this merchant type once it has been sent.

Can I Stop Or Revoke A Transaction While It's Pending?

Until the transaction is finalized, you have no option except to let it go through. In most cases, a transaction will be processed within 3–5 business days. However, this time frame can range from 3–10 business days. If you desire to contest a transaction, you must wait until it is no longer pending.

How Do I Stop An Pending Payment Transaction On My Account?

While a transaction is pending, you cannot reverse it. If a Merchant requests the Bank to release or revoke a pending transaction, the Bank will do so immediately. To request the cancellation or reversal of a pending transaction, the Merchant must provide us with the following information on firm letterhead:

Number of Cards

Use-by date

Identity of Cardholder

Several authorizations, if any.

Permitted Funds Amount

Conclusion

A pending transaction has been authorized by your card issuer but has not yet been processed. Any pending transactions will reduce the quantity of available credit or cash. In most cases, you will need to get in touch with the Merchant who initiated the charge to cancel the transaction. It's too late to contest a charge that was still pending when you checked your account online.

Susan Kelly Dec 22, 2023

Explore Tenancy by the Entirety: Joint Property Ownership in Marriage

15860

Susan Kelly Nov 24, 2023

Taking a Gap Year

31782

Triston Martin Dec 05, 2023

Beginner's Guide to Credit Cards: Top 6 for Getting Started

22487

Triston Martin Dec 25, 2023

Form 1040 Explained: Key Features of The U.S. Individual Tax Returns

29956

Triston Martin Feb 05, 2024

Financial Milestones by Age 40: What Should You Save?

3649

Susan Kelly Feb 21, 2024

Analyzing Municipal Bonds: Is Investing in Munis the Right Choice?

42090

Triston Martin Dec 26, 2023

Top Agriculture Stocks; Why to Invest in Top Agriculture Stocks?

36535

Susan Kelly Dec 23, 2023

Comparing Phone Trade-Ins and Sales: Assessing the Better Financial Gain

92563